Examining all aspects and looking at both the long-term results and short-term gains before deciding which course of action to take will provide the most clarity when it comes time to make a decision. Generally speaking, if one way will require more work to complete but will result in higher quality outcomes, this should definitely be considered in the process. Still, other methods might save time but require more resources or take longer to execute.

- This is because the amount of accounts payable that the company needs to make payment to the supplier under both methods is at the same amount.

- The company will record the purchase discount as a credit to the purchase discount account and a debit to the accounts payable account $100.

- The cost of accepting purchase discounts should be weighed against the cost of alternative methods of financing.

- Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

- If we use the example above, the gain to the business of paying 1, days earlier than expected was the purchase discount of 30.

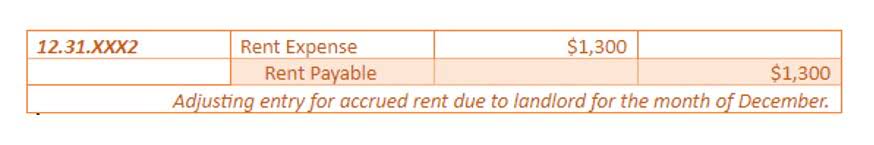

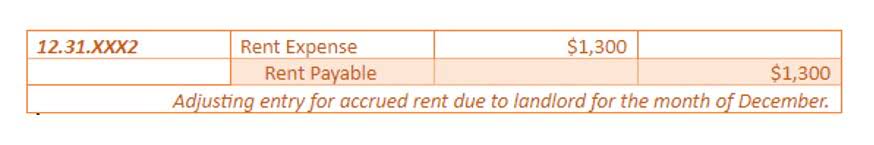

Entry:

Additionally, it may result in overstating profits by not recognizing any purchase discounts at the time of payment. Purchase Discount refers to the discount that the buyer avails of the goods to settle a particular debt earlier than the actual settlement date. During the normal course of the business, it is highly likely that businesses might procure certain goods or services on credit. However, regardless of the agreed-upon credit limit and timeline, the seller often offers a cash discount to the purchaser of goods and services to motivate him to settle the amount earlier than the agreed-upon date. In this method, the discount received is recorded as the reduction in merchandise inventory. Therefore, the amount of discount is recorded on credit to the merchandise inventory account.

Would you prefer to work with a financial professional remotely or in-person?

- The Gross Method helps to provide accurate financial information by making sure payment amounts reflect reality, rather than showing inflated sales figures or artificially lowered expenses.

- This is because cash discounts require payment within a specified period of time, thus increasing the cash flow of the business immediately.

- In these circumstances the business needs to record the full amount of the purchase when invoiced and ignore any discount offered in the supplier terms.

- When a business purchases goods on credit from a supplier the terms will stipulate the date on which the amount outstanding is to be paid.

This article looks at meaning of and differences between two methods of accounting for cash discount offered in the books of accounts of the seller or vendor – gross method and net method of cash discount. Money is constantly needed by businesses to run their daily operations, service financing costs and undertake any growth plans. This means that the purchase amount will be reduced by the value of any discounts and only the net total (after taking into account discounts) will be recorded in accounts payable. For example, if a company purchases $100 worth of goods and receives a 10% discount, the total amount of the cash paid will be reduced to $90.

Net Method of Recording Purchase Discounts

- It reduces the expenses or cash outflow of the company, but it could not be considered the revenues under the accounting principle.

- If the business fails to take the discount, the entry to record the payment will be straight forward.

- By recording this adjustment, the accounts payable need to be adjusted back to the full invoice amount.

- This is a quick way to compare the differences between how the two methods record the details involved with inventory.

Purchase Discounts, Returns, Allowances and other contra expense accounts may be presented on the income statement as individual line items or aggregated into a single contra-expense line if immaterial or preferable. In the accounting general ledger, the accounting for purchase discounts credit balances of the contra purchase expense accounts reduce and offset the usual debit balances reported in the standard purchase expense accounts. Purchase Discounts, Returns and Allowances are contra expense accounts that carry a credit balance, which is contrary to the normal debit balance of regular expense accounts.

- In an effort to increase sales, manufacturers usually allow retailers 30 days to pay for goods that are purchased.

- My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

- Therefore, to set that off, trade discounts are offered which incentivizes buyers of a certain product to pay early, at a cheaper cost.

- The discount is recorded in a contra expense account which is offset against the appropriate purchases or expense account in the income statement.

- It is important to note that while discounts can be beneficial, they should be monitored and managed carefully to ensure they are not having a negative effect on profits.

- Digital methods are quickly emerging as the preferred choice for many modern businesses.

This is due to, under the perpetual system, the company records the purchase into the inventory account directly without the purchase account. Hence, it needs to make credit entry to reverse the inventory account when it receives the discount as any amount of the discount will reduce the cost of inventory. As the company does not record the inventory purchase under the periodic system, whether it receives the discount or not, the journal entry will not involve the inventory account like those in the perpetual system. If the business fails to take the discount, the entry to record the payment will be straight forward. For example, if a business offers a 10% discount, it will reduce the initial income generated from the sale. However, the long-term effect may be positive if the discount increases future sales through customer loyalty.

The Impact on Cash Flow

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited https://www.bookstime.com/ by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. If the firm takes the discount, an account titled Purchase Discounts will be credited for the amount of the discount.

This is a quick way to compare the differences between how the two methods record the details involved with inventory. This is because it records the effect of the discount at the time of purchase, rather than later when payment is https://www.instagram.com/bookstime_inc made. An aspect that needs to be noted here is that only cash purchase discounts are included as subtractions from gross purchases. Therefore, to set that off, trade discounts are offered which incentivizes buyers of a certain product to pay early, at a cheaper cost. If the business pays within 10 days then a 2% purchase discount amounting to 30 can be deducted from the purchase invoice, and the business will pay only 1,470 to settle the supplier account.

Businesses are always looking for ways to save money while still being able to serve their customers best. Trade discount is offered by distributors to retailers, and is not available to end customers. Furthermore, the use of the account, Purchase Discounts Lost; highlights the total cost of not paying within the discount period. The argument for treating discounts lost as interest expense is based on the fact that the firm consciously chose not to pay within the allowable discount period, thus causing an additional cost. On the other hand, the seller’s incentive to offer discounts is simply the fact that he is going to receive the total amount much earlier than the requested date. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.