This is an excellent read for people without any accounting knowledge as it explains complex topics in easy to understand terms. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation.

Accounting for the Numberphobic: A Survival Guide for Small Business Owners

When doing the bookkeeping, you’ll generally follow the following four steps to make sure that the books are up to date and accurate. Remember that each what is work in process inventory transaction is assigned to a specific account that is later posted to the general ledger. Posting debits and credits to the correct accounts makes reporting more accurate.

Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports

But after spending yet another evening to sorting out my business’s finances, I finally decided to give accounting software a shot. After (finally) finding the right tool for my business—poof—my time was mine again. Each of the accounting books on this list of 15 has been chosen for its ability to address specific challenges and knowledge gaps in the accounting discipline.

Review and pay quarterly payroll taxes

Having fun with your business’ financials and considering going right into the accounting field? This guide is an invaluable resource for those preparing for the CPA Financial Accounting & Reporting Exam. It demystifies the exam’s challenging content, balancing your cash drawer offering crucial tips, and practice questions to aid in mastering the material needed to pass the test confidently.

- Whether you’re learning to create financial statements, handle taxes, or detect fraud, this book offers valuable insights and practical tips to manage your business’s finances effectively.

- The last step of the accounting cycle is to prepare a post-closing trial balance to test the equality of the debits and credit amounts after the closing entries are made.

- Ronan Hughes is an experienced accountant and author dedicated to assisting small business owners in navigating the complexities of accounting.

- Holtzman provides a clear roadmap to understanding how managerial accounting supports strategic planning and organizational control in any business setting.

- At the end of the accounting period, the accountant must prepare the adjusting entries to update the accounts that are summarized in the financial statements.

Start your free trial with Shopify today—then use these resources to guide you through every step of the process. One of the last things you’ll do after closing out your books for the year is file forms with the IRS. If you’re still feeling uncertain, don’t be afraid to speak with a professional bookkeeping service about securing their help.

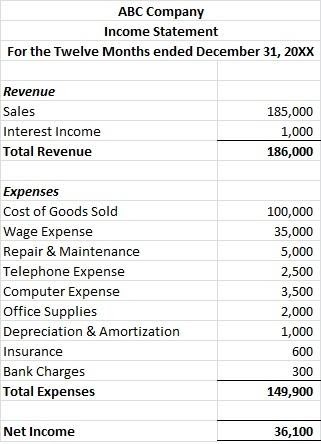

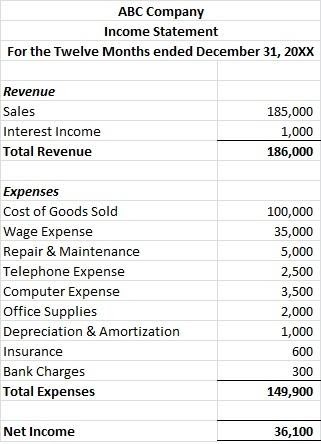

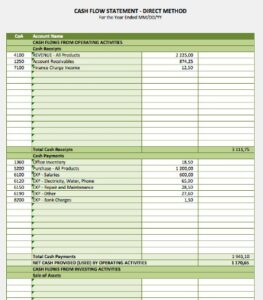

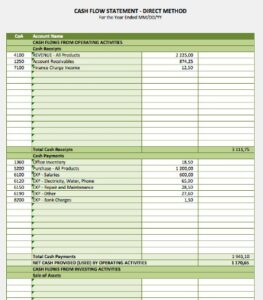

The book introduces readers to the fundamentals of financial accounting in a straightforward manner. You’ll explore essential concepts, practices, and terminology, acquiring the skills to interpret and utilize financial information effectively for business planning and decision-making. While not explicitly an accounting book, I threw this one in for business owners unsure of the next legal step, as it touches on the legal implications of your business’ tax accounting. ClydeBank Business presents a straightforward and actionable guide to forming and operating a Limited Liability Company (LLC) with ease and efficiency. Sometimes, people freeze up at the mention of a net income statement or cash flow report.

As its title suggests, Small Time Operator focuses on solo practitioners, home businesses, small ecommerce businesses, and contractors juggling clients. If this describes you, you may find valuable financial and accounting guidance in this book, which includes best practices for bookkeeping, tax reporting, and financing your business. In this text, accountant Greg Crabtree discusses how accounting practices can seamlessly lead to a business strategy that grows your company. This book is designed for people who are just as interested in entrepreneurship as they are in bookkeeping.

This book offers step-by-step instructions on creating and interpreting financial reports and detailed real-world examples to help you apply those learnings. Bragg’s guide is an essential read for accountants and finance professionals who aspire to modernize their practices and stay ahead in a rapidly evolving field. For non-finance managers aiming to bridge the gap in their financial understanding, Sheriff’s guide is an invaluable resource. Every business owner, regardless of the industry, needs a robust understanding of financials, and Oliver’s guide is the perfect foundation. Delve into budgeting techniques, financial report analysis, and strategies to manage examples of inherent risk and forecast your business finances for maximum profitability. For students, entrepreneurs, or finance professionals seeking a refresher, Bauerle’s guide offers a comprehensive yet concise overview of accounting fundamentals.

Barron’s Accounting Handbook is a robust reference, encompassing an expansive coverage of accounting rules, standards, and practices. Siegel and Shim have created a work that dives into the depth of accounting, making it indispensable for both novices and seasoned professionals. Here’s a quick summary of each book, what you’ll learn, why you should read it, and a quote I like from each book. David H. Ringstrom is a certified public accountant and a recognized expert in the field of accounting software. For aspiring CPAs, this study guide is a beacon, illuminating the path to successful exam preparation and completion.

With expert insight and clear instructions, it simplifies the process of setting up and navigating through QuickBooks Online, helping businesses effectively manage their finances. Joanne M. Flood is an expert in accounting principles and a prominent author in the field. To stay updated with her latest works and insights, connect with her on LinkedIn. The book provides an in-depth analysis and understanding of GAAP, detailing the latest updates and amendments. It serves as both a textbook and a reference guide, with examples, illustrations, and practical advice to help you navigate through GAAP’s complex regulations confidently.